[*images maybe holding images until release date]

We are specialists in the practical application of Artificial Intelligence including Fraud Detection AI, Machine Learning, Deep Learning and Data Science Software used within Travel processes and operations

AI can train from financial transaction data. When it has learnt what's normal, AI can react rapidly to fraudulent/ abnormal money patterns.

The power of fraud detection

Being able to automatically spot fraud based on past knowledge and experience of normal state is a powerful tool in all aspects of business and industry.

By learning from past procedures, operating states and occurrences, including positive events, negative events, and all the in-between variable and unpredictable events that happen during normal run time; fraud detection is more informed, impactful, accurate, and more likely to result in prevention of financial loss

Importantly, faster, accurate fraud detection potentially saves time, cost and other resources in the future to a much greater degree than manual processes.

The more past data, experience, knowledge, events, processes and transactional data to learn from the more accurate and informed the fraud detection process will be.

AI makes automatic fraud detection possible

Learning from past states of play, gained-knowledge and experiences in order to decide whether fraud is happening might sound straightforward - this is how a human brain would detect fraud - but making this process automatic and asking a machine to do this is extremely complex and demanding, mainly due to the large amount of variability involved.

If a traditional software programming approach was used, the computer would continually be asking "if this, then do that; if x and y, do z". This stepwise methodology is limited, restrictive and resource-heavy as the program will only do what it has explicitly been told to look for by the programmer; making it next to impossible to account for all possibilities and variations, even in the simplest of detection systems and processes. You certainly couldn't use this approach for complex and diverse processes and large scale transactions.

With AI and Machine Learning technology it is now possible to learn from near infinite amounts of variable, constantly changing data in order to spot fraud rapidly and automatically.

ELDR Fraud is a powerful Deep Learning package that can help spot fraud based on a highly variable past and complex normal state of play it has learnt from

ELDR Fraud is a variant of Fennaio's core AI predictive analytics software - ELDR Predictor. Using our powerful ELDR AI Engine, which is a Deep Learning Artificial Neural Network, ELDR Fraud uses supervised learning to make and link complex relationships from state of play data (of any size or complexity) passed to it.

When ELDR has learnt (trained) from the data, it is then primed to receive current-status data from which to check for occurrences of fraud.

A simple example using ELDR Fraud

Consider you are a Bank IT Manager and for the last year you have been monitoring and recording financial transactions going through your Stocks and Shares buying and selling service. Despite the monitoring, frauds which you only spotted a month later when you manually looked at the data.

With ELDR Fraud, you simply pass your normal transaction data set in (with a large and unlimited fields e.g. time of day, location, country), and using labelled/supervised learning, ELDR will make all the links between all data sets, accounting for wide variation. You can then probe ELDR in real time with current transaction status to see if the particular state is considered normal.

ELDR Fraud is highly dynamic, autonomous, configurable, graphical and easily integrated

Dynamic

ELDR Fraud can handle and learn from multiple sources, sizes and complexities of data for numerous prediction requirements simultaneously. Data can be changed at any time and it can continually learn.

Autonomous

By default ELDR is plug and play - you can simply give it appropriately formatted data and it will automatically learn from it, including self optimisation and self scaling.

Configurable

In many cases you may be happy with plug and play, however almost everything in ELDR is configurable; from which data fields to use as inputs and outputs, to colours, displays, output format, learning modes, learning accuracy, all the way through to Artificial Neural Network dynamics and dimensions.

Graphical

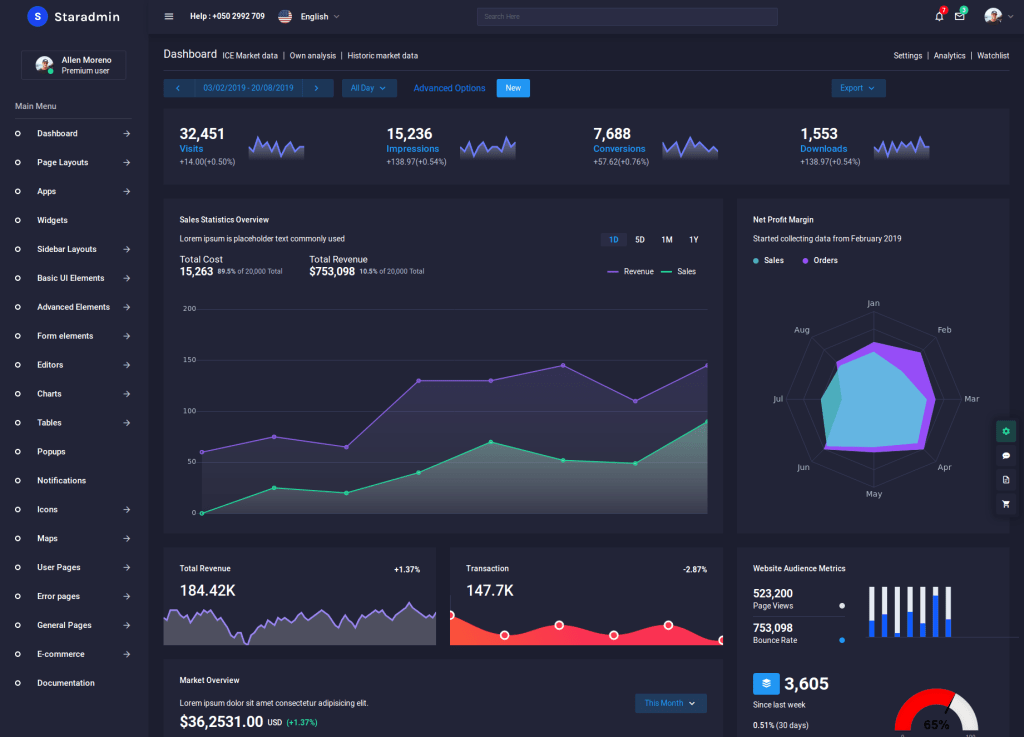

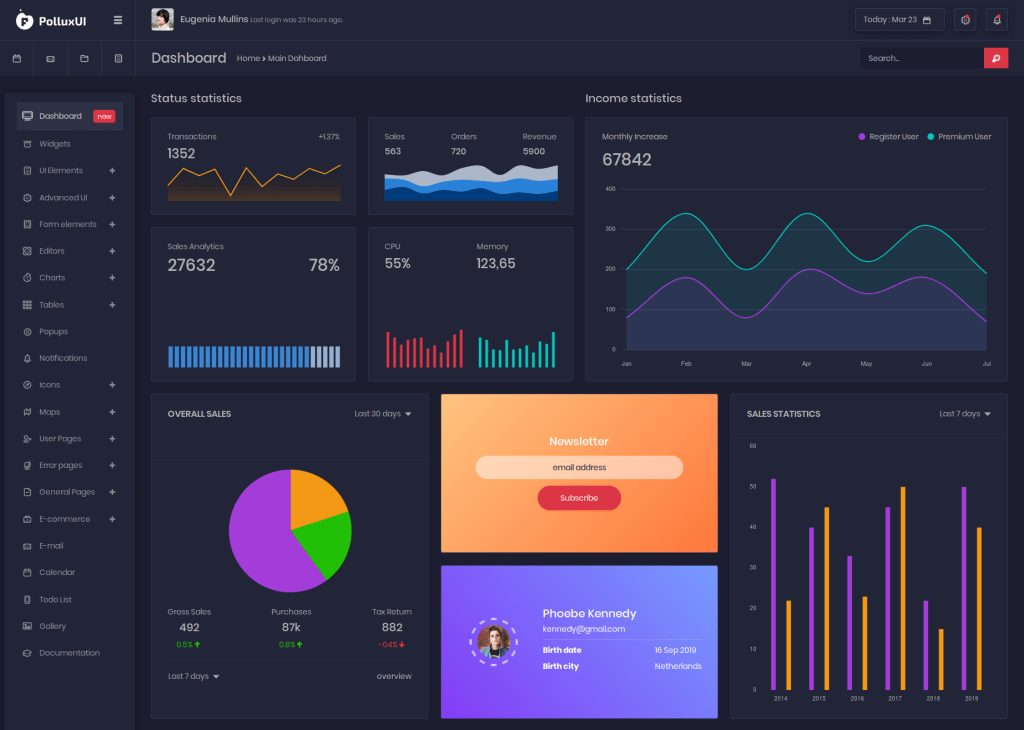

ELDR Fraud uses a rich intuitive GUI Dashboard from which to manage the whole AI process (data preparation, learning, outputting and testing), including a comprehensive suite of gamified charts and other visual displays to monitor everything.

Easily Integrated

AI Integration is our speciality. We understand that AI can be used in a variety of ways and in numerous system-types and processes. We build our software to be entirely modular and there are multiple integration methods and points ranging from network-based RESTFulAPI integration to direct coupling at the code level, depending on the response time required, amongst other considerations.

Key points about our Fraud Detection AI software

- Can help detect fraud in any process automatically

- Can handle numerous data streams and outputs simultaneously

- Uses our powerful ELDR AI Deep Learning Artificial Neural Network Engine

- Dynamic

- Autonomous

- Configurable

- Graphical

- Easily Integrated

Example areas where Fennaio can help with AI, Machine Learning and Deep Learning in the Travel industry

AI can be used all over the Travel industry, including these processes, operations and tasks:

- planning

- forecasting

- predictions

- weather

- customer profiling

- booking and ticketing

- fraud detection

- process optimisation

- customer service

- market analysis

- route planning

- availability

- big data insights

- targeted packages

- online advertising

- many more...